Introduction

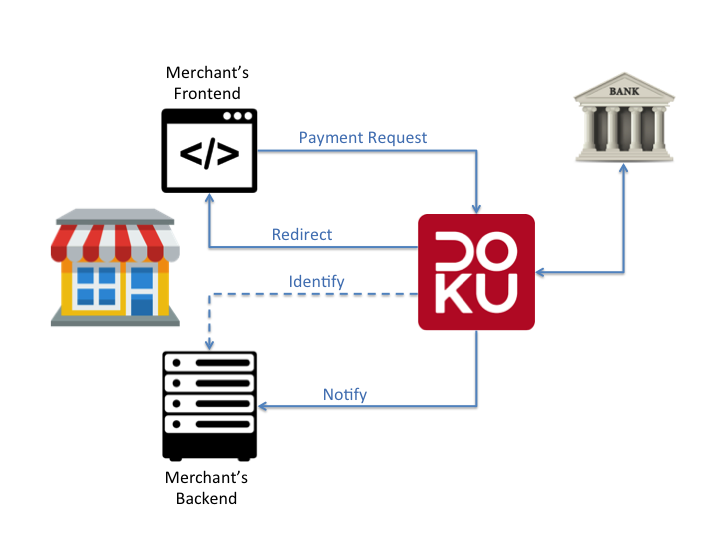

The DOKU API supports two methods of payment processing – namely, merchant-hosted and DOKU-hosted. See below for features of each service:

DOKU Hosted (DH) Instant payment services where the payment input form is located within the DOKU page. The selection of payment methods can be done on the merchant or DOKU page. With this service, the customer will be redirected to a DOKU-hosted page upon checkout to complete the payment.

Merchant Hosted (MH) The payment page and data input is native to the merchant’s website, without having to redirect to a DOKU-hosted page. Having the payment form on the merchant page does not compromise the security of the cardholder however, none of the cardholder data will actually be stored on the merchant’s server.

Channels and Features

Credit card

DOKU accept all credit card issued with these Principals:

- Mastercard

- Visa

- JCB (Only for BNI Acquiring)

Credit card transaction in Indonesia Online Merchant is usually required additional security from issuer Bank, called 3D Secure (3DS). This process will ask the genuine credit card holder to enter Internet PIN or One Time PIN (OTP) that usually sent to Credit Card Holder mobile phone.

BIN Filtering

Each card issuer has a unique BIN (Bank Identification Number), which is made up of the first 6 digits in the Credit Card number. The conditions set in the filter will specify which BIN numbers that are allowed to make payments on your site. When a card number that has been blocked by the BIN filter is entered, the DOKU server will not be able to process the payment.

Installment

DOKU supported credit card installment payment. There are 2 types of installment type supported:

- On-us installment, where card issuer and card acquirer are from the same bank.

- Off-us installment, where card issuer and card acquirer are from different bank. Transaction conversion from regular to installment will be processed manually from each Card issuer.

Merchant can trigger installment payment by adding some parameters in payment request to DOKU.

Tokenization

Tokenization enables the customer to make a purchase without having to input card details or personal information, apart from the CVV number. This process is typically used by merchants that have repeat customers who will benefit from a faster checkout by reducing the number of fields the customer needs to fill in. If the card issuer requires 3D secure verification process, the customer will still have to complete this to make a purchase. In order for this process to work, the customer enters all of the card information only during the very first time they make a purchase. DOKU stores this data in a secure form and gives the merchant a token, which is paired to the customer’s login credentials on the merchant website. After this process has been completed, each time they make a payment from hereon out, they only have to input the CVV.

Recurring

Recurring payment takes it a step further and allows the customer to make a purchase with a single click on the website. This means that they can skip the process of inputting their card details, personal information, CVV number and 3D secure. The customer will have to enter the card details and complete the 3D secure verification process only during the first time they make a purchase. By eliminating the extra steps, you are able to create a more seamless and easy checkout process, which may lead to a lower drop-off rate. However, please note that this is subject to DOKU’s and the bank’s approval due to an increase in fraud risk.

Authorize and Capture

Authorize & Capture is a feature that allows you to block a certain amount from the customer’s credit card limit (Authorize), then hold it for a certain period before charging a payment – which can be a different amount from what you block (Capture).

DOKU Wallet

DOKU Wallet is an electronic money service issued by DOKU. DOKU has grant license to issue e-money from Bank Indonesia. For more information about DOKU Wallet, you can check on the website

Internet Banking

DOKU accept bank account debit payment and consumer financing payment. All of it is categorized as internet banking payment. Below are the list of internet banking channels and the supported API:

| Payment Channel | API supported |

|---|---|

| Mandiri Clickpay | DH & MH |

| BCA Klikpay | DH |

| BRI e-Pay | DH |

| Muamalat | DH |

| Danamon | DH |

| Permata Net | DH |

| CIMBClicks | DH |

| Kredivo | DH |

| KlikBCA | KlikBCA API |

| BNI Yap! | BNI Yap API |

Virtual Account

Virtual Account Number is issued for banks or convenience stores payment. Payment is initiated from bank's or convenience store's channels such as ATM, mobile banking, internet banking, or over the counter / teller.

| Payment Channel | API | Off-us |

|---|---|---|

| Permata | DH & MH | Yes |

| BCA | DH & MH | No |

| Mandiri | DH & MH | Yes |

| Sinarmas | DH & MH | Yes |

| CIMB Niaga | DH & MH | Yes |

| Danamon | DH & MH | Yes |

| BRI | DH & MH | Yes |

| BNI VA | DH | Yes |

| Alfa | DH & MH | No |

| Indomaret | DH & MH | No |

| QNB | MH | Yes |

| BTN | MH | Yes |

| Maybank | DH & MH | Yes |

| Arta Jasa | DH & MH | Yes |

Direct inquiry

Direct inquiry is a feature that allows DOKU to inquire Virtual Account Number / Payment Code to merchant when payment inquiry is requested from bank or convenience store. To integrate direct inquiry, merchant should respond payment inquiry as defined in this specification.

Reusable

Reusable is a feature that allows merchant's customer to pay a Virtual Account multiple times without the same Virtual Account Number / Payment Code getting expired.

Check Status, Void, Refund, Cancellation

Check Status Feature

DOKU provide feature for merchant to check status of the payment transaction. To implement Check Status, please find API here

Void, Refund, Cancellation

There are some methods to modify status of success transaction:

- Void is cancelling unsettled credit card transaction. Please find API here

- Refund is cancelling settled credit card transaction. Please find API here

- Cancellation is an API to Void or Refund success transaction in a single request. If transaction is unsettled, DOKU will request Void to bank. If transaction is settled, DOKU will send Refund request to bank. Please find API here

Getting Started

- To integrate, merchant should have ID from DOKU which is called Mall ID or Merchant Code. Please register on DOKU Merchant to get your ID.

- Prepare some URL and page in testing and production environment, especially for DOKU Hosted integration.

Special Characters

Due to security purpose, not all special characters are allowed in parameters sent. Special characters allowed by DOKU are:

, . & ; + : / =

Currency and Country code

DOKU use ISO3166 as country and currency code standard. You can see the code list on this URL:

https://www.iso.org/obp/ui/

DOKU IP Address / URL

Sample of IP filtering

@$REMOTE_ADDR;

or

$_SERVER[‘REMOTE_ADDR’];

DOKU has only 3 IP public that can be detected when DOKU call to your application (Identify, Notify & Redirect functions). So to make those applications process ONLY from DOKU is by using DOKU IP Address. Although, High Anonymous Proxy or IP Masking/Hide/Change tools on most current network application can still penetrate this feature, this will reduce most of injection false information to the applications to create genuine transactions.

Below are the URL of DOKU API:

Staging URL https://staging.doku.com/

Production URL https://pay.doku.com/

Shared Key Hash Value

To secure the communication, besides IP filtering, DOKU implements Shared Key Hash Value - an additional parameter from Merchant or DOKU, called WORDS. This parameter value is hashed using 4 options hash method with combination of Shared Key. The hashed WORDS generated by Merchant will be validated with hashed WORDS generated by DOKU System and vice versa. If match, then it will be considered genuine request or response. Four options hash methods that Merchant can choose are: SHA1, SHA256, HMAC-SHA1, HMAC-SHA256.

Sample using IDR:

$WORDS=sha1(40000.00123map_aztec977872);

Sample using USD Currency:

$WORDS=sha1(40000.00123map_aztec977872);

Below is a sample combination string:

WORDS = sha1 (AMOUNT + MALLID + Shared Key + TRANSIDMERCHANT )

Or if using currency other than IDR :

WORDS = sha1 (AMOUNT + MALLID + Shared Key + TRANSIDMERCHANT + CURRENCY)

Shared Key is generated by DOKU and displayed in Settings menu on DOKU Merchant dashboard.

DOKU Hosted API

Before integration, it is recommended to configure some URL in DOKU Merchant dashboard. You can check the configuration in menu 'Settings > API Setting'. URL that can be configured are:

- URL Identify

- URL Notify

- URL Redirect

- URL Review

Payment Request

| Endpoint | Method | Definition |

|---|---|---|

| /Suite/Receive | HTTP POST | Merchant submits payment request using HTML Post from Customer's browser to DOKU Hosted Payment Page |

Parameters for Payment Request

| Parameter | Type | Length | Description |

|---|---|---|---|

| MALLID | N | 10 | Merchant ID given by Doku |

| CHAINMERCHANT | N | 8 | Given by Doku. If not using Chain, use value: NA |

| AMOUNT | N | 12.2 | Total amount. Eg: 10000.00 |

| PURCHASEAMOUNT | N | 12.2 | Total amount. Eg: 10000.00 |

| TRANSIDMERCHANT | AN | 30 | Transaction ID from Merchant |

| PAYMENTTYPE | AN | 13 | SALE or AUTHORIZATION. Default is SALE |

| WORDS | AN | 254 | Hashed key combination encryption. The hashed key generated from combining these parameters value in this order:AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT For transaction with currency other than 360 (IDR), use: AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT+CURRENCY For Shared Key, refer to Shared Key Hashed Value |

| REQUESTDATETIME | N | 14 | YYYYMMDDHHMMSS |

| CURRENCY | N | 3 | ISO3166, numeric code |

| PURCHASECURRENCY | N | 3 | ISO3166, numeric code |

| SESSIONID | AN | 48 | Merchant can use this parameter for additional validation, DOKU will return the value in other response process. |

| NAME | AN | 128 | Customer / Buyer name |

| ANS | 254 | Customer / Buyer email | |

| ADDITIONALDATA | ANS | 1024 | Custom additional data for specific merchant use |

| BASKET | ANS | 1024 | Show transaction description. Use comma to separate each field and semicolon for each item. E.g. Item1,1000.00,2,20000.00;item2,15000.00,2,30000.00 |

| SHIPPING_ADDRESS | ANS | 100 | Mandatory for Kredivo payment channel. Shipping address contains street and number |

| SHIPPING_CITY | ANS | 100 | Mandatory for Kredivo payment channel. City name |

| SHIPPING_STATE | AN | 100 | State or Province name |

| SHIPPING_COUNTRY | ANS | 3 | Mandatory for Kredivo payment channel. ISO3166, alpha |

| SHIPPING_ZIPCODE | ANS | 10 | Mandatory for Kredivo payment channel. ZIP Code |

| PAYMENTCHANNEL | N | 2 | See Payment Channel Code |

| ADDRESS | ANS | 100 | Home address contains street and number |

| CITY | ANS | 100 | City name |

| STATE | AN | 100 | State or Province name |

| COUNTRY | A | 3 | ISO3166, alpha |

| ZIPCODE | N | 10 | Zip Code |

| HOMEPHONE | ANS | 11 | Home Phone |

| MOBILEPHONE | ANS | 15 | Mobile Phone |

| WORKPHONE | ANS | 13 | Work Phone / Office Phone |

| BIRTHDATE | N | 8 | YYYYMMDD |

Additional Parameters for Airlines

Airlines merchant is required to send some additional specific parameters on payment request. Below are the parameters:

| Parameter | Type | Length | Description |

|---|---|---|---|

| FLIGHT | N | 2 | 01 for Domestic, 02 for International |

| FLIGHTTYPE | N | 1 | 0 : One Way, 1 : Return, 2 : Transit, 3 : Transit & Return, 4 : Multiple Cities |

| BOOKINGCODE | AN | 20 | Booking code generated by Airline |

| ROUTE* | AN | 50 | List of route using format XXX-YYY (from XXX to YYY). E.g. : CGK-DPS |

| FLIGHTDATE* | AN | 8 | List of flight date using format YYYYMMDD |

| FLIGHTTIME* | AN | 6 | List of flight time using format HHMMSS |

| FLIGHTNUMBER* | AN | 30 | List of flight number using IATA Standard. XXYYYY (XX = Airline Name, YYYY = Flight Number) |

| PASSENGER_NAME* | ANS | 50 | List of passenger name in one booking code |

| PASSENGER_TYPE* | AN | 1 | List of passenger type in one booking. A : Adult, C : Child |

| VAT | N | 12.2 | Total VAT. Eg: 10000.00 |

| INSURANCE | AN | 12.2 | Total Insurance. Eg: 10000.00 |

| FUELSURCHARGE | AN | 12.2 | Total fuel surcharge. Eg: 10000.00 |

| THIRDPARTY_STATUS | ANS | 1 | 0 : Travel Arranger joins the flight, 1 : Travel Arranger does not join the flight |

| FFNUMBER | ANS | 16 | Frequent Flyer Number. If no Frequent Flyer Number, send "0" |

Additional Parameters for Credit Card Installment

Credit Card Installment payment require some additional specific parameters on payment request. Below are the parameters:

| Parameter | Type | Length | Description |

|---|---|---|---|

| INSTALLMENT_ACQUIRER | N | 3 | Acquirer code for installment |

| TENOR | N | 2 | Number of month to pay the installment |

| PROMOID | N | 3 | Promotion ID from the bank for the current merchant |

Additional Parameters for Tokenization (First Payment)

In the DOKU Hosted API, Credit Card Tokenization is treated as a separate payment method from the un-tokenized Credit Card. Please send PAYMENTCHANNEL parameter in Payment Request with value 16.

| Parameter | Type | Length | Description |

|---|---|---|---|

| CUSTOMERID | AN | 16 | Merchant’s customer identifier |

| PAYMENTCHANNEL | N | 2 | 16 |

Additional Parameters for Second Payment Request

| Parameter | Type | Length | Description |

|---|---|---|---|

| CUSTOMERID | AN | 16 | Merchant’s customer identifier |

| TOKENID | AN | 16 | Tokenized Card Identifier |

| PAYMENTCHANNEL | N | 2 | 16 |

Additional Parameters for Recurring Registration

In the DOKU-Hosted API, Credit Card Recurring is treated as a separate payment method. Please send PAYMENTCHANNEL parameter in Payment Request with value 17.

| Parameter | Type | Length | Description |

|---|---|---|---|

| CUSTOMERID | AN | 16 | Merchant’s customer identifier |

| BILLNUMBER | AN | 16 | Merchant’s bill identifier |

| BILLDETAIL | ANS | 256 | Product information |

| BILLTYPE | A | 1 | S= Shopping, I = Installment, D = Donation, P = Payment |

| STARTDATE | N | 8 | Recurring start date yyyyMMdd |

| ENDDATE | N | 8 | Recurring end date yyyyMMdd , NA = end date not specified |

| EXECUTETYPE | A | 4 | DAY or DATE or FULLDATE |

| EXECUTEDATE | AN | 3 | If EXECUTETYPE = DAY then SUN / MON / TUE / WED / THU / FRI / SAT . If EXECUTETYPE = DATE then 1/2/3/.../28 . If EXECUTETYPE = FULLDATE then list of execute dates in yyyyMMdd |

| EXECUTEMONTH | A | 3 | JAN / FEB / MAR / APR / MAY / JUN / JUL / AUG / SEP / OCT / NOV / DEC |

| FLATSTATUS | A | 5 | If the amount is dynamic, use value: FALSE. Use TRUE if the amount is fixed. |

| REGISTERAMOUNT | N | 12.2 | Registration amount Eg: 10000.00 |

Identify

Allow Merchant to identify the payment channel that Customer has chosen. Merchant should configure Identify URL in DOKU Merchant Dashboard settings. Example : http://www.yourwebsite.com/directory/DOKU_identify.php

This IDENTIFY Process is not a mandatory process. This IDENTIFY process also does not require Merchant’s response. Feel free to use or not use this process based on your business process and requirement.

Parameters for Identify

| Parameter | Type | Length | Description |

|---|---|---|---|

| AMOUNT | N | 12.2 | Total amount. Eg: 10000.00 |

| TRANSIDMERCHANT | AN | 30 | Transaction ID from Merchant |

| PAYMENTCHANNEL | N | 2 | See Payment Channel Code |

| SESSIONID | AN | 48 | DOKU will return the value from Payment Request |

Redirect

Redirecting back to Merchant’s domain. Merchant should inform the URL where DOKU will redirect. Example: http://www.yourwebsite.com/directory/DOKU_redirect.php

Parameters for Redirect

| Parameter | Type | Length | Description |

|---|---|---|---|

| AMOUNT | N | 12.2 | Total amount. Eg: 10000.00 |

| TRANSIDMERCHANT | AN | 30 | Transaction ID from Merchant |

| WORDS | AN | 254 | Hashed key combination encryption. The hashed key generated from combining these parameters value in this order: AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT+RESULTMSG+VERIFYSTATUS |

For transaction with currency other than 360 (IDR), use : AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT+RESULTMSG+VERIFYSTATUS+CURRENCY |

|||

| Refer to Shared Key Hashed Value | |||

| STATUSCODE | N | 4 | 0000: Success, others Failed |

| PAYMENTCHANNEL | N | 2 | See Payment Channel Code |

| SESSIONID | AN | 48 | DOKU will return the value from Payment Request |

| PAYMENTCODE | N | 16 | Virtual Account identifier for VA transaction. Has value if using Channel that has payment code. |

| CURRENCY | N | 3 | ISO3166 , numeric code |

| PURCHASECURRENCY | N | 3 | ISO3166 , numeric code |

Notify

Notify API allows Merchant to have a real-time payment status notification. Merchant should inform the URL where DOKU server will send the notification message. Example: http://www.yourwebsite.com/directory/DOKU_notify.php

By default DOKU will IGNORE merchant’s response but merchant have an option for DOKU to reverse the payment if merchant’s response is not appropriate or time out occurs.

Respond Notify

print CONTINUE

Parameters for Notify

| Parameter | Type | Length | Description |

|---|---|---|---|

| AMOUNT | N | 12.2 | Total amount. Eg: 10000.00 |

| TRANSIDMERCHANT | AN | 30 | Transaction ID from Merchant |

| WORDS | AN | 254 | Hashed key combination encryption. The hashed key generated from combining these parameters value in this order: AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT+RESULTMSG+VERIFYSTATUS For transaction with currency other than 360 (IDR), use : AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT+RESULTMSG+VERIFYSTATUS+CURRENCY |

| Refer to Shared Key Hashed Value | |||

| STATUSTYPE | A | 1 | Default value : P |

| RESPONSECODE* | N | 4 | 0000: Success, others Failed |

| APPROVALCODE | AN | 20 | Transaction number from bank |

| RESULTMSG* | A | 20 | SUCCESS or FAILED |

| PAYMENTCHANNEL | N | 2 | See Payment Channel Code |

| PAYMENTCODE | N | 8 | Virtual Account identifier for VA transaction. Has value if using Channel that has payment code. |

| SESSIONID | AN | 48 | DOKU will return the value from Payment Request. |

| BANK | AN | 100 | Bank Issuer |

| MCN | ANS | 16 | Masked card number |

| PAYMENTDATEANDTIME | N | 14 | YYYYMMDDHHMMSS |

| VERIFYID | N | 30 | Generated by Fraud Screening (RequestID) |

| VERIFYSCORE | N | 3 | -1 or 0 - 100 |

| VERIFYSTATUS | A | 10 | APPROVE / REJECT / REVIEW / HIGHRISK / NA |

| CURRENCY | N | 3 | ISO3166 , numeric code |

| PURCHASECURRENCY | N | 3 | ISO3166 , numeric code |

| BRAND | A | 10 | VISA / MASTERCARD |

| CHNAME | AN | 50 | Cardholder Name |

| THREEDSECURESTATUS | A | 5 | TRUE or FALSE |

| LIABILITY | A | 10 | CUSTOMER / MERCHANT / NA |

| EDUSTATUS | A | 10 | Manual Fraud Review, value : APPROVE / REJECT / NA (default) |

| CUSTOMERID | AN | 16 | Merchant’s customer identifier (If using Tokenization) |

| TOKENID | AN | 16 | Merchant’s customer identifier (If using Tokenization) |

* Main identifier of transaction success / failed

Merchant Hosted API

Merchant hosted integration is more advanced than DOKU Hosted. DOKU provide sample function to facilitate Merchant to integrate with Merchant Hosted API. Below are the list of sample functions:

- DOKU sample function to create WORDS in PHP. Please find sample code here

- DOKU sample function to request to DOKU API in PHP. Please find sample code here

- DOKU sample function to save API URL. Please find sample code here

Credit Card Integration

Step 1

<script src="https://cdnjs.cloudflare.com/ajax/libs/fancybox/2.1.5/jquery.fancybox.pack.js"></script>

<link href="https://cdnjs.cloudflare.com/ajax/libs/fancybox/2.1.5/jquery.fancybox.min.css" rel="stylesheet">

<script src="http://staging.doku.com/doku-js/assets/js/doku-1.2.js"></script>

<link href="http://staging.doku.com/doku-js/assets/css/doku.css" rel="stylesheet">

To get started on your integration, follow these steps one by one by pasting the template scripts onto your website. The DOKU payment form is saved in HTML format; the template script acts as a placeholder for where the payment form will appear on your page. Prepare your HTML pages as seen in the template, and customize accordingly.

Step 1: Insert the doku-1.2.js, fancybox.js and fancybox.css onto your website’s payment page, along with your custom style.

Step 2

<?php require_once('../Doku.php');

Doku_Initiate::$sharedKey = ‘<Put Your Shared Key Here>’;

Doku_Initiate::$mallId = ‘<Put Your Merchant Code Here>’;

$invoice = 'invoice_1458123951’;

$params = array('amount' => '10000.00','invoice' => $invoice, 'currency' => '360');

$words = doku_Library::doCreateWords($params); ?>

Step 2: Initialize the payment form by creating the 'WORDS' using function sample

Step 3

<script type="text/javascript">

$(function() {

var data = new Object();

data.req_merchant_code = '1';

data.req_chain_merchant = 'NA';

data.req_payment_channel = '15'; // ‘15’ = credit card

data.req_transaction_id = '<?php echo $invoice ?>';

data.req_currency = '<?php echo $currency ?>';

data.req_amount = '<?php echo $amount ?>';

data.req_words = '<?php echo $words ?>';

data.req_form_type = 'full';

getForm(data, ‘staging’); //for production environment, change ‘staging’ to ‘production’

});

</script>

Step 3: Add following example script on to webpage

Step 4

<form action="charge.php" method="POST" id="payment-form">

<div doku-div='form-payment'>

<input id="doku-token" name="doku-token" type="hidden" />

<input id=" doku-pairing-code" name="doku-pairing-code" type="hidden" />

</div>

</form>

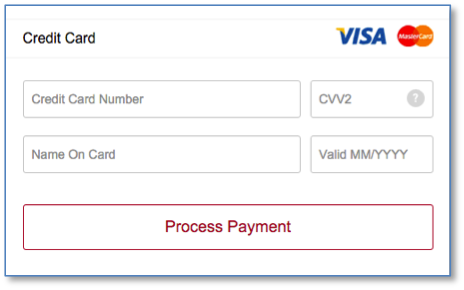

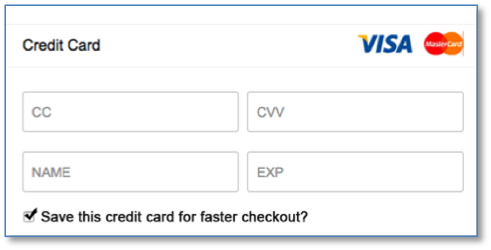

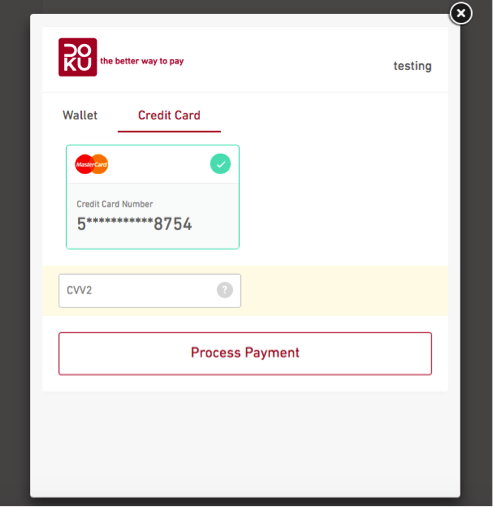

Step 4: Insert the template script where you wish the payment form to appear on your website. When completed correctly, the payment form should appear as seen below, and you may start receiving payments immediately. The DOKU script only provides the four fields to be filled in by the customer. All other parts of the payment page, including the logo and ‘Process Payment’ button are customizable to your needs for a completely white label payment flow.

Once your customer has input their card data and clicked the “Process Payment” button, the data will be processed by DOKU. The DOKU server then responds with the card ID, and the browser will post the data to the merchant server, according to the URL set in your action form.

Payment Request Sample

<?php require_once('../Doku.php');

Doku_Initiate::$sharedKey = ‘<Put Your Shared Key Here>’;

Doku_Initiate::$mallId = ‘<Put Your Merchant Code Here>’;

$token = $_POST['doku-token'];

$pairing_code = $_POST['doku-pairing-code'];

$invoice_no = $_POST['doku-invoice-no'];

$params = array('amount' => '10000.00', 'invoice' => $invoice_no, 'currency' => '360', 'pairing_code' => $pairing_code, 'token' => $token);

$words = Doku_Library::doCreateWords($params);

$basket[] = array('name' => 'sayur', 'amount' => '10000.00', 'quantity' => '1', 'subtotal' => '10000.00');

$customer = array('name' => 'TEST NAME','data_phone' => '08121111111', 'data_email' => 'test@test.com', 'data_address' => 'bojong gede #1 08/01');

$dataPayment = array('req_mall_id' => Doku_Initiate::$mallId, 'req_chain_merchant' => 'NA','req_amount' => '10000.00','req_words' => $words, 'req_purchase_amount' => '10000.00', 'req_trans_id_merchant' => $invoice_no, 'req_request_date_time' => date('YmdHis'), 'req_currency' => '360', 'req_purchase_currency' => '360', 'req_session_id' => sha1(date('YmdHis')), 'req_name' => $customer['name'], 'req_payment_channel' => 15, 'req_basket' => $basket, 'req_email' => $customer['data_email'], 'req_token_id' => $token);

$result = Doku_Api::doPayment($dataPayment);

if($result->res_response_code == '0000'){

echo 'SUCCESS'; //success

}else{

echo 'FAILED'; //failed }

Due to potential fraud, Indonesia is a 3D Secure market, where customer authentication is required to proceed with the transaction. The form of authentication differs form each bank, but typically it involves a One-Time Password sent via SMS. Not all issuing banks in Indonesia have implemented 3D secure, but the majority of them have. Further assessment by DOKU and the acquiring bank is required to grant a non-3D secure Merchant ID.

You can retrieve the posted data from the form within your server. Then send the payment request to the DOKU server to be processed using our sample function.

BIN Filtering integration

BIN filtering

<?php

require_once('../Doku.php');

Doku_Initiate::$sharedKey = '<Put Your Shared Key Here>'; Doku_Initiate::$mallId = '<Put Your Merchant Code Here>';

$data = array('req_token_id' => $data['doku-token'], 'req_pairing_code' => $data['doku-pairing-code'], 'req_bin_filter' => array("42*1", "4?3??3","411111","5*"), 'req_words' => $words );

$responsePrePayment = Doku_Api::doPrePayment($data);

if($responsePrePayment->responseCode == '0000'){ //prepayment success, then you can do payment

}else{ // Pre payment fail

}

In order to apply the BIN filter, you must insert the following conditions into a prepayment request. The prepayment request must be sent before the actual payment request. You can add several conditions by separating with a comma. Afterwards, you may insert your original payment request form.

Tokenization integration

Follow these steps to apply tokenization to your credit card payment process:

Tokenization Step 1

<script type="text/javascript">

$(function() {

var data = new Object();

data.req_merchant_code = '1';

data.req_chain_merchant = 'NA';

data.req_payment_channel = '15';

data.req_transaction_id = '<?php echo $invoice ?>';

data.req_currency = '<?php echo $currency ?>';

data.req_amount = '<?php echo $amount ?>';

data.req_words = '<?php echo $words ?>';

data.req_form_type = 'full';

data.req_customer_id = '12124';

getForm(data, ‘staging’); //for production environment, change ‘staging’ to ‘production’

});

</script>

Step 1: Insert the additional script to your server under the payment data.

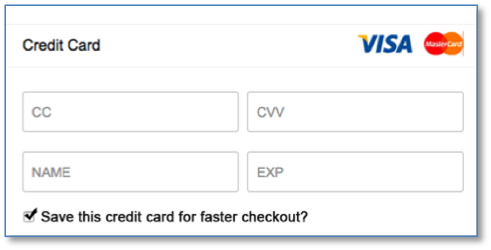

To initialize tokenization, follow the same steps as general credit card processing, but add the additional parameter “data.reg_customer_id” to your javascript under the payment data. The “data.reg_customer_id” parameter may represent the customer ID that you assign to each customer within your database. This ID will be paired with the token that DOKU gives in the status response.

The javascript with the additional parameter will generate the following payment form, which enables the customer to save their credit card, for faster payment. When a transaction is sent as a tokenization to DOKU, in addition to the 4 fields for credit card data, DOKU will also display on the merchant website a tick box asking the customer’s approval to save the card.

Tokenization Step 2

{

"res_approval_code":"844647",

"res_trans_id_merchant":"1706221359",

"res_amount":"30000.00",

"res_payment_date_time":"20160319114638",

"res_verify_score":"-1",

"res_verify_id":"",

"res_verify_status":"NA",

"res_words":"7553a51a091775a2462eb9150c7135f4a8d58ff161db022ca42e0ef65666ebf0",

"res_response_msg":"SUCCESS",

"res_mcn":"4***********1111",

"res_mid":"000100013000195",

"res_bank":"JPMORGAN CHASE BANK",

"res_response_code":"0000",

"res_session_id":"4cf212f141a1d7fe672db93db75cc069,PRODUCTION",

"res_payment_channel":"15",

"res_bundle_token":"{"res_token_payment":"0bea1c1c653dbc8e1e6c24155c629fe237325a06", "res_token_msg":"SUCCESS", "res_token_code":"0000" }"

}

Step 2: Generate and save the token during the first payment.

When the customer has filled in their card details and clicked “Process Payment”, the data is sent to the DOKU server. Because the ‘data.reg_customer_id’ parameter has been added to the payment form, the DOKU server will create a token to pair with the Customer ID. If the customer checks the box next to “Save this Credit Card for faster checkout?” the payment response to the Merchant server will include this token.

Tokenization Step 3

<script type="text/javascript">

$(function() {

var data = new Object();

data.req_merchant_code = '1';

data.req_chain_merchant = 'NA';

data.req_payment_channel = '15';

data.req_transaction_id = '<?php echo $invoice ?>';

data.req_currency = '<?php echo $currency ?>';

data.req_amount = '<?php echo $amount ?>';

data.req_words = '<?php echo $words ?>';

data.req_form_type = 'full';

data.req_customer_id = '12124';

data.req_token_payment = '0bea1c1c653dbc8e1e6c24155c629fe237325a06';

getForm(data, ‘staging’); //for production environment, change ‘staging’ to ‘production’

});

</script>

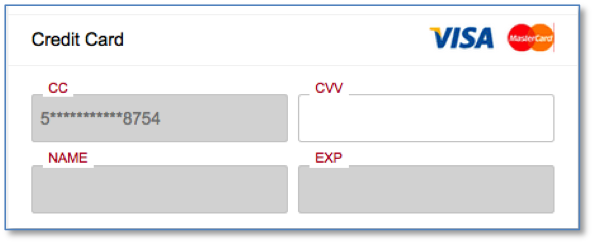

Step 3: For subsequent payments, retrieve the token from your database and send it to the DOKU server.

After a successful first payment, (assuming that the merchant has been correctly storing the Token data) only a slight modification needs to be made to the javascript. Add the extra parameter ‘data.reg_token_payment’ as seen below, by using the token value that was obtained during the first payment.

The sample script will generate following payment form:

As you can see from the image above, the customer no longer needs to fill out the credit card data apart from the CVV number. When the customer clicks the “Process Payment” button, it will follow the same process as regular card payments.

Register Recurring integration

Follow these steps to apply Register recurring payment to your credit card payment process:

<script type="text/javascript">

$(function() {

var data = new Object();

data.req_merchant_code = '1';

data.req_chain_merchant = 'NA';

data.req_payment_channel = '15';

data.req_transaction_id = '<?php echo $invoice ?>';

data.req_currency = '<?php echo $currency ?>';

data.req_amount = '<?php echo $amount ?>';

data.req_words = '<?php echo $words ?>';

data.req_form_type = 'full';

data.req_customer_id = '12124';

getForm(data, ‘staging’); //for production environment, change ‘staging’ to ‘production’

});

</script>

Step 1: Insert the additional script to your server under the payment data.

To initialize recurring payment, follow the same steps as general credit card processing, but add the additional parameter data.reg_customer_id to your javascript under the payment data. The “data.reg_customer_id” parameter may represent the customer ID that you assign to each customer within your database. This ID will be paired with the token that DOKU gives in the status response.

The javascript with the additional parameter will generate the following payment form, which enables the customer to save their credit card.

Register Recurring Step 2

{

"res_approval_code":"844647",

"res_trans_id_merchant":"1706221359",

"res_amount":"30000.00",

"res_payment_date_time":"20160319114638",

"res_verify_score":"-1",

"res_verify_id":"",

"res_verify_status":"NA", "res_words":"7553a51a091775a2462eb9150c7135f4a8d58ff161db022ca42e0ef65666ebf0", "res_response_msg":"SUCCESS",

"res_mcn":"4***********1111",

"res_mid":"000100013000195",

"res_bank":"JPMORGAN CHASE BANK",

"res_response_code":"0000", "res_session_id":"4cf212f141a1d7fe672db93db75cc069,PRODUCTION", "res_payment_channel":"15", "res_bundle_token":"{"res_token_payment":"0bea1c1c653dbc8e1e6c24155c629fe237325a06",

}

Step 2: Generate and save the token during the first payment. When the customer has filled in their card details and clicked “Process Payment”, the data is sent to the DOKU server. Because the ‘data.reg_customer_id’ parameter has been added to the payment form, the DOKU server will create a token to pair with the Customer ID. If the customer checks the box next to “Save this credit card for faster checkout?”, the payment response to the Merchant server will include this token.

When the payment response is received, store it in your database for the next payment using the 1-Click service.

Register Recurring Step 3

<script type="text/javascript"> $(function() {

var data = new Object();

data.req_merchant_code = '1';

data.req_chain_merchant = 'NA';

data.req_payment_channel = '15';

data.req_transaction_id = '<?php echo $invoice ?>';

data.req_currency = '<?php echo $currency ?>';

data.req_amount = '<?php echo $amount ?>';

data.req_words = '<?php echo $words ?>';

data.req_form_type = 'full';

data.req_customer_id = '12124';

data.req_token_payment = '0bea1c1c653dbc8e1e6c24155c629fe237325a06';

getForm(data, ‘staging’); //for production environment, change ‘staging’ to ‘production’

});

</script>

Step 3: For subsequent payments, retrieve the token from your database and send it to the DOKU server.

After a successful first payment, (assuming that the merchant has been correctly storing the Token data) only a slight modification needs to be made to the javascript. Add the extra parameter data.reg_token_payment , by using the token value that was obtained during the first payment:

The sample script will not generate another payment form, but will instead just display the “Process Payment” button.

Register Recurring Step 4

<?php require_once('../Doku.php');

Doku_Initiate::$sharedKey = ‘<Put Your Shared Key Here>’;

Doku_Initiate::$mallId = '<Put Your Merchant Code Here>';

$params = array('amount' => '100000.00', 'invoice' => '123456789');

$words = Doku_Library::doCreateWords($params);

$customer = array('name' => 'TEST NAME', 'data_phone' => '08121111111', 'data_email' => 'test@test.com', 'data_address' => 'bojong gede #1 08/01');

$basket[] = array('name' => 'sayur', 'amount' => '10000.00', 'quantity' => '1', 'subtotal' => '10000.00');

$basket[] = array('name' => 'buah', 'amount' => '10000.00', 'quantity' => '1', 'subtotal' => '10000.00');

$dataPayment = array('req_mall_id' => Doku_Initiate::$mallId, 'req_chain_merchant' => 'NA', 'req_amount' => $params['amount'], 'req_words' => $words, 'req_purchase_amount' => $params['amount'], 'req_trans_id_merchant' => $params['invoice'], 'req_request_date_time' => date('YmdHis'), 'req_currency' => '360', 'req_purchase_currency' => '360', 'req_session_id' => sha1(date('YmdHis')), 'req_name' => $customer['name'], 'req_payment_channel' => '15', 'req_email' => $customer['data_email'], 'req_basket' => $basket, 'req_address' => $customer['data_address'], 'req_token_payment' => '0bea1c1c653dbc8e1e6c24155c629fe237325a06', 'req_customer_id' => '12345');

$response = Doku_Api::doDirectPayment($dataPayment);

if($response->res_response_code == '0000'){ echo 'PAYMENT SUCCESS -- ';

}else{

echo 'PAYMENT FAILED -- ';

}

?>

Step 4: Change method of payment in the payment request form.

Once your customer has input their card data and clicked the “Process Payment” button, the data will be processed and DOKU will send a response containing the card ID. When you retrieve this data from your server, create the payment request following the instructions for regular credit card payments. However, when you make the payment request, you must change the method of payment to Doku_Api::doDirectPayment instead of Doku_Api::doPayment.

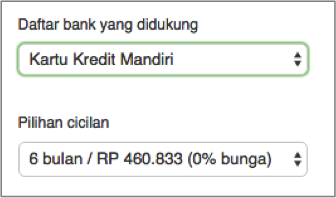

Installment integration

Below are the integration process that you need to go through to enable both types of installment:

Step 1: Create an installment form on your payment page Installment integration follows the same steps as a normal credit card payment, only with a few additional parameters. To start, please create an installment selection form on your payment page for your customer to choose their card issuer and preferred payment plan along with the doku-1.2.js credit card form. The installment form may look like this:

Installment Data sample

$dataPayment = array(

'req_mall_id' => Doku_Initiate::$mallId,

'req_chain_merchant' => 'NA',

'req_amount' => '10000.00',

'req_words' => $words,

'req_purchase_amount' => '10000.00',

'req_trans_id_merchant' => $invoice_no,

'req_request_date_time' => date('YmdHis'),

'req_currency' => '360',

'req_purchase_currency' => '360',

'req_session_id' => sha1(date('YmdHis')),

'req_name' => $customer['name'],

'req_payment_channel' => 15,

'req_basket' => $basket,

'req_email' => $customer['data_email'],

'req_token_id' => $token,

'req_installment_acquirer' => ‘100’, // from merchant

'req_tenor' => ‘12’, // from merchant

'req_plan_id' => ‘001’ // from merchant,

'req_installment_off_us' => ‘O‘ // only for off-us transaction

)

Step 2: Send Payment Request There is no difference in the parameters sent from doku-1.2.js to your server, please do it as you would for a normal credit card payment. However, pair the credit card payment request parameters together with the installment information as you would need to combine the two when conducting the server-to-server payment charging process.

Step 3: Charge payment to DOKU server along with the installment parameters Send a payment charge request to DOKU using the usual DOKU library, only with the additional installment parameters. Installment_acquirer refers to the acquirer bank code, tenor is the number of months in the installment plan, plan_id is a promotion code the merchant has form the bank, and installment_off_us with value ‘O’ only for off-us transaction.

Authorize & Capture integration

The integration process for Authorize & Capture works as follow

Authorize

Autohorize payment data

$dataPayment = array(

'req_mall_id' => Doku_Initiate::$mallId, 'req_chain_merchant' => 'NA',

'req_amount' => '10000.00',

'req_words' => $words,

'req_purchase_amount' => '10000.00',

'req_trans_id_merchant' => $invoice_no,

'req_request_date_time' => date('YmdHis'),

'req_currency' => '360',

'req_purchase_currency' => '360',

'req_session_id' => sha1(date('YmdHis')),

'req_name' => $customer['name'],

'req_payment_channel' => 15,

'req_basket' => $basket,

'req_email' => $customer['data_email'],

'req_token_id' => $token

'req_authorize_expiry_date’ => ‘1440’ // from merchant, per minute (optional)

'req_payment_type’ => ‘A’,

)

To send a payment authorization request, follow the exact same steps as a normal credit card payment charging request, with additional parameters that you send during the server-to-server process

"req_authorize_expiry_date" refers to the time limit (in minutes) that you want to impose on authorizing a certain amount of the card limit; the maximum is 15 days. While the value ‘A’ for "req_payment_type" refers to an Authorize request. During this process DOKU will check whether there is still enough limit on the card to Authorize the amount. After successfully completing the Authorize process, you will receive an "approval_code" parameter. Store and pair it with your "trans_id_merchant" parameter to later complete the Capture process.

Capture

Capture payment data

$dataPayment = array(

'req_mall_id' => Doku_Initiate::$mallId,

'req_chain_merchant' => 'NA',

'req_amount' => '10000.00',

'req_words' => $words,

'req_trans_id_merchant' => $invoice_no,

'req_request_date_time' => date('YmdHis'),

'req_session_id' => sha1(date('YmdHis')),

'req_payment_channel' => 15,

'req_approval_code’ => ‘’ // based on authorize transaction

)

To capture, simply send a server-to-server charging request to DOKU as shown by example below. You do not have to follow the full credit card steps since the customer does not have to fill in their card details anymore and getToken process can be bypassed.

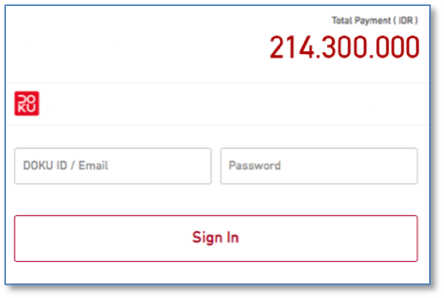

DOKU Wallet Integration

Step 1

<script src="https://cdnjs.cloudflare.com/ajax/libs/fancybox/2.1.5/jquery.fancybox.pack.js"></script>

<link href="https://cdnjs.cloudflare.com/ajax/libs/fancybox/2.1.5/jquery.fancybox.min.css" rel="stylesheet">

<script src="http://staging.doku.com/doku-js/assets/js/doku-1.2.js"></script>

<link href="http://staging.doku.com/doku-js/assets/css/doku.css" rel="stylesheet">

DOKU Wallet have similar way to integrate like credit card. To get started on your integration, follow these steps one by one by pasting the template scripts onto your website. The DOKU payment form is saved in HTML format; the template script acts as a placeholder for where the payment form will appear on your page. Prepare your HTML pages as seen in the template, and customize accordingly.

Step 2

<?php require_once('../Doku.php');

Doku_Initiate::$sharedKey = ‘<Put Your Shared Key Here>’;

Doku_Initiate::$mallId = '<Put Your Merchant Code Here>';

$invoice = 'invoice_1458123951’;

$params = array('amount' => '10000.00', 'invoice' => $invoice, 'currency' => '360');

$words = doku_Library::doCreateWords($params);

?>

Doku Wallet integration comprises 3 steps:

Step 1: Insert JavaScript

Insert the doku-1.2.js, fancybox.js and fancybox.css onto your website’s payment page, along with your custom style.

Step 2: Initiate JavaScript parameters Initialize the payment form by creating the words using function sample

<script type="text/javascript">

$(function() {

var data = new Object();

data.req_merchant_code = '1';

data.req_chain_merchant = 'NA';

data.req_payment_channel = '04';

data.req_transaction_id = '<?php echo $invoice ?>';

data.req_currency = '<?php echo $currency ?>';

data.req_amount = '<?php echo $amount ?>';

data.req_words = '<?php echo $words ?>';

data.req_form_type = 'full';

getForm(data, ‘staging’); //for production environment, change ‘staging’ to ‘production’

});

</script>

And add the example script on to your webpage.

Step 3

<form action="charge.php" method="POST" id="payment-form">

<div doku-div='form-payment'>

<input id="doku-token" name="doku-token" type="hidden" />

<input id=" doku-pairing-code" name="doku-pairing-code" type="hidden" />

</div>

</form>

Step 3: Create payment form Insert the template script where you wish the payment form to appear on your website. When completed correctly, the payment form should appear as seen below, and you may start receiving payments immediately. The DOKU script only provides the two fields to be filled in by the customer. All other parts of the payment page, including ‘Process Payment’ button are customizable to your needs.

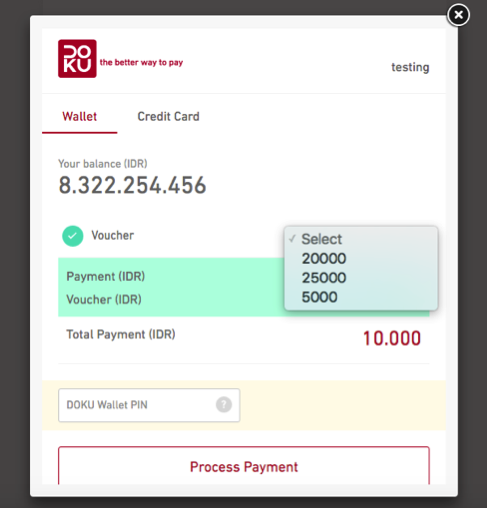

Once your customer has input their DOKU ID and signed in to their account, their balance and payment options will appear in a pop-pup window, which follows the DOKU template, like this:

The customer may choose to pay with their existing cash balance and may apply a Voucher or Promo Code if he/she has a valid one. The customer may also choose to pay with the Credit Card that has been linked to their DOKU Wallet. Note however, that to activate the credit card option, further process is required. If the Credit Card option is not yet activated for you and you would like to do so, please contact DOKU.

<?php require_once('../Doku.php');

Doku_Initiate::$sharedKey = ‘<Put Your Shared Key Here>’;

Doku_Initiate::$mallId = '<Put Your Merchant Code Here>';

$token = $_POST['doku-token'];

$pairing_code = $_POST['doku-pairing-code'];

$invoice_no = $_POST['doku-invoice-no'];

$params = array('amount' => '10000.00', 'invoice' => $invoice_no, 'currency' => '360', 'pairing_code' => $pairing_code, 'token' => $token);

$words = Doku_Library::doCreateWords($params);

$basket[] = array('name' => 'sayur', 'amount' => '10000.00', 'quantity' => '1', 'subtotal' => '10000.00');

$customer = array('name' => 'TEST NAME', 'data_phone' => '08121111111', 'data_email' => 'test@test.com', 'data_address' => 'bojong gede #1 08/01');

$data = array('req_token_id' => $token, 'req_pairing_code' => $pairing_code, 'req_customer' => $customer, 'req_basket' => $basket, 'req_words' => $words);

$responsePrePayment = Doku_Api::doPrePayment($data);

if($responsePrePayment->res_response_code == '0000'){ //prepayment success

$dataPayment = array('req_mall_id' => '1', 'req_chain_merchant' => 'NA', 'req_amount' => '10000.00', 'req_words' => $words, 'req_purchase_amount' => '10000.00', 'req_trans_id_merchant' => $invoice_no, 'req_request_date_time' => date('YmdHis'), 'req_currency' => '360', 'req_purchase_currency' => '360', 'req_session_id' => sha1(date('YmdHis')), 'req_name' => $customer['name'], 'req_payment_channel' => 04, 'req_basket' => $basket, 'req_email' => $customer['data_email'], 'req_token_id' => $token);

$result = Doku_Api::doPayment($dataPayment);

if($result->res_response_code == '0000'){

echo 'SUCCESS'; //success

}else{

echo 'FAILED'; //failed

}

}else{ //prepayment fail

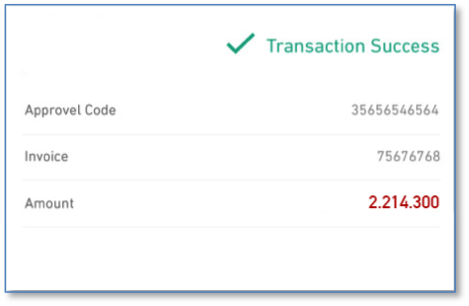

When the customer clicks the “Process Payment” button, the DOKU server will process the data and send a response to the browser. The browser will then post the data to the merchant server, according to the URL set in your action form. You can retrieve the posted data from the form within your server. Then send the payment request to the DOKU server to be processed using our function sample

After this, you may display the result on your browser for the customer to see.

Virtual Account Integration

Virtual Account payment process comprise 2 asynchronous process: Generate Payment Code (Virtual Account Number), and Payment Process.

<?php require_once('../Doku.php');

date_default_timezone_set('Asia/Jakarta');

Doku_Initiate::$sharedKey = <Put Your Shared Key Here>;

Doku_Initiate::$mallId = <Put Your Merchant Code Here>

$params = array('amount' => $_POST['amount'], 'invoice' => $_POST['trans_id'], 'currency' => $_POST['currency']);

$words = Doku_Library::doCreateWords($params);

$customer = array('name' => 'TEST NAME','data_phone' => '08121111111', 'data_email' => 'test@test.com', 'data_address' => 'bojong gede #1 08/01');

$dataPayment = array('req_mall_id' => $_POST['mall_id'], 'req_chain_merchant' => $_POST['chain_merchant'], 'req_amount' => $params['amount'], 'req_words' => $words, 'req_trans_id_merchant' => $_POST['trans_id'], 'req_purchase_amount' => $params['amount'], 'req_request_date_time' => date('YmdHis'), 'req_session_id' => sha1(date('YmdHis')), 'req_email' => $customer['data_email'], 'req_name' => $customer['name'], 'req_basket' => 'sayur,10000.00,1,10000.00;', 'req_address' => 'Jl Kembang 1 No 5 Cilandak Jakarta', 'req_mobile_phone' => '081987987999', 'req_expiry_time' => '360');

$response = Doku_Api::doGeneratePaycode($dataPayment);

if($response->res_response_code == '0000'){

echo 'GENERATE SUCCESS -- ';

}else{

echo 'GENERATE FAILED -- ';

} ?>

Generate Payment Code

Payment Code generated by DOKU will have total 16 digits length. The payment code consist of 5 digits or 8 digits prefix from Bank/DOKU, continued with 11 digits or 8 digits number generated by DOKU. Both of request type (8 digits or 11 digits payment code) have different endpoint / URL.

Step 1: Generate Payment Code By using the our function sample, you can make a payment code request with ease. The request process is performed host to host.

You can set payment code expiry time in parameter ‘req_expiry_time’. Exceeding this time limit will render the payment code invalid. You may set the time limit however you like, in minute format.

Sample of generate payment code response

{

"res_pay_code":"62700000003",

"res_pairing_code":"290316110837531987",

"res_response_msg":"SUCCESS",

"res_response_code":"0000"

}

Step 2: Receive DOKU response. DOKU will respond generate payment code request in JSON format. Response contain payment code generated (8 digits or 11 digits).

Step 3: Display Payment Code in Merchant's browser It is suggested to display payment code that already combined with 5 digits or 8 digits prefix for each payment channel.

Receive Payment Notification

Sample of virtual account payment notification

PAYMENTDATETIME=20160329110948

PURCHASECURRENCY=360

PAYMENTCHANNEL= FROM DOKU

AMOUNT=10000.00

PAYMENTCODE=00100000029

WORDS=01d9b362d3c1b80ff9196c6a565c49e5d9b03b8a

RESULTMSG=SUCCESS

TRANSIDMERCHANT=ZA912172

BANK=PERMATA

STATUSTYPE=P

APPROVALCODE=068992

RESPONSECODE=0000

SESSIONID=7b6647973dd13211a7fcf42eba79acea68aa69a1

Step 1: After the customer has made a payment, DOKU will send a payment notification containing the payment parameters to your server.

Sample of handling payment notification

<?php

$PAYMENTDATETIME = $_POST[‘PAYMENTDATETIME’];

$PURCHASECURRENCY = $_POST[‘PURCHASECURRENCY’];

$PAYMENTCHANNEL = $_POST[‘PAYMENTCHANNEL’];

$AMOUNT = $_POST[‘AMOUNT’];

$PAYMENTCODE = $_POST[‘PAYMENTCODE’];

$WORDS = $_POST[‘WORDS’];

$RESULTMSG = $_POST[‘RESULTMSG’];

$TRANSIDMERCHANT = $_POST[‘TRANSIDMERCHANT’];

$BANK = $_POST[‘BANK’];

$STATUSTYPE = $_POST[‘STATUSTYPE’];

$APPROVALCODE = $_POST[‘APPROVALCODE’];

$RESPONSECODE = $_POST[‘RESPONSECODE’];

$SESSIONID = $_POST[‘ SESSIONID’]

$WORDS_GENERATED = <function to generate words> //see function sample

if ( $WORDS == $WORDS_GENERATED )

{

echo “CONTINUE”;

}

else

{

echo “WORDS NOT MATCH”;

}

?>

Step 2: Notify DOKU server that Payment Notification has been received by responding "CONTINUE".

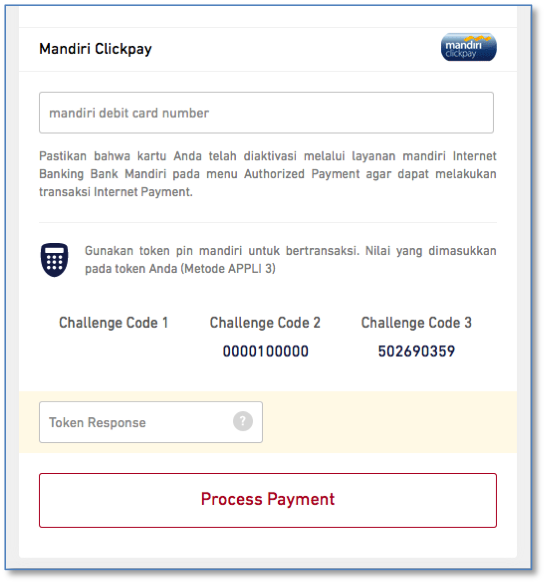

Mandiri Clickpay Integration

Internet banking payment channel supported in Merchant Hosted currently only Mandiri Clickpay. To get started on your integration, follow these steps one by one by pasting the template scripts onto your website. The DOKU payment form is saved in HTML format; the template script acts as a placeholder for where the payment form will appear on your page. Prepare your HTML pages as seen in the template, and customize accordingly. The form you create in this step will receive the Mandiri Clickpay input from the customer.

<script src="doku-1.2.js"></script>

<link href="http://staging.doku.com/doku-js/assets/css/doku.css" rel="stylesheet">

<script src='http://staging.doku.com/doku-js/assets/js/jquery.payment.min.js'></script>

Step 1: Insert the doku-1.2.js onto your website’s payment page, along with your custom style.

js URL:

| Environment | URL |

|---|---|

| staging | http://staging.doku.com/doku-js/assets/js/jquery.payment.min.js |

| production | https://pay.doku.com/doku-js/assets/js/doku-1.2.js?version=1497508770 |

css URL:

| Environment | URL |

|---|---|

| staging | http://staging.doku.com/doku-js/assets/css/doku.css |

| production | https://pay.doku.com/doku-js/assets/css/doku.css |

Step 2

<script type="text/javascript">

jQuery(function($) {

$('.cc-number').payment('formatCardNumber');

var challenge3 = Math.floor(Math.random() * 999999999);

$("#CHALLENGE_CODE_3").val(challenge3);

});

$(function() {

var data = new Object();

data.req_cc_field = 'cc_number';

data.req_challenge_field = 'CHALLENGE_CODE_1';

dokuMandiriInitiate(data);

});

</script>

Step 2: Initialize the payment form by adding the following example script onto your webpage.

Step 3

<form method="post" action="../example/mandiri-clickpay-charge.php">

<div id="mandiriclickpay" class="channel">

<div class="list-chacode">

<ul>

<li>

<div class="text-chacode">Challenge Code 1</div>

<input type="text" id="CHALLENGE_CODE_1" name="CHALLENGE_CODE_1" readonly="true" required/>

<div class="clear"></div>

</li>

<li>

<div class="text-chacode">Challenge Code 2</div>

<div class="num-chacode">0000100000</div>

<input type="hidden" name="CHALLENGE_CODE_2" value="0000100000"/>

<div class="clear"></div>

</li>

<li>

<div class="text-chacode">Challenge Code 3</div>

<div class="num-chacode" id="challenge_div_3"></div>

<input type="hidden" name="CHALLENGE_CODE_3" id="CHALLENGE_CODE_3" value=""/>

<div class="clear"></div>

</li>

<div class="clear"></div>

</ul>

</div>

<div class="validasi">

<div class="styled-input fleft width50">

<input type="text" required="" name="response_token">

<label>Respon Token</label>

</div>

<div class="clear"></div>

</div>

<input type="hidden" name="invoice_no" value="invoice_1458547984">

<input type="button" value="Process Payment" class="default-btn" onclick="this.form.submit();">

</div>

</form>

Step 3: Insert the template script where you wish the payment form to appear on your website.

Step 4: When completed correctly, the payment form should appear as seen below, and you may start receiving payments using Mandiri Clickpay immediately.

Once your customer has input their Mandiri Clickpay data and clicked the “Process Payment” button, the data will be processed on DOKU. The DOKU server responds to the browser, and the data will be posted to the merchant server, according to the URL set in you action form.

Step 5

<?php require_once('../Doku.php');

Doku_Initiate::$sharedKey = '<Put Your Shared Key Here>';

Doku_Initiate::$mallId = '<Put Your Merchant Code Here>';

$params = array('amount' => '100000.00', 'invoice' => $_POST['invoice_no']);

$cc = str_replace(" - ", "", $_POST['cc_number']);

$words = Doku_Library::doCreateWords($params);

$customer = array('name' => 'TEST NAME', 'data_phone' => '08121111111', 'data_email' => 'test@test.com', 'data_address' => 'bojong gede #1 08/01');

$basket[] = array('name' => 'sayur', 'amount' => '10000.00', 'quantity' => '1', 'subtotal' => '10000.00');

$basket[] = array('name' => 'buah', 'amount' => '10000.00', 'quantity' => '1', 'subtotal' => '10000.00');

$dataPayment = array('req_mall_id' => '1', 'req_chain_merchant' => 'NA', 'req_amount' => $params['amount'], 'req_words' => $words, 'req_purchase_amount' => $params['amount'], 'req_trans_id_merchant' => $_POST['invoice_no'], 'req_request_date_time' => date('YmdHis'), 'req_currency' => '360', 'req_purchase_currency' => '360', 'req_session_id' => sha1(date('YmdHis')), 'req_name' => $customer['name'], 'req_payment_channel' => '02', 'req_email' => $customer['data_email'], 'req_card_number' => $cc, 'req_basket' => $basket, 'req_challenge_code_1' => $_POST['CHALLENGE_CODE_1'], 'req_challenge_code_2' => $_POST['CHALLENGE_CODE_2'], 'req_challenge_code_3' => $_POST['CHALLENGE_CODE_3'], 'req_response_token' => $_POST['response_token'], 'req_mobile_phone' => $customer['data_phone'], 'req_address' => $customer['data_address']);

$response = Doku_Api::doDirectPayment($dataPayment);

if($response->res_response_code == '0000'){

echo 'PAYMENT SUCCESS -- ';

}else{

echo 'PAYMENT FAILED -- ';

}

var_dump($response);

?>

Step 5: You can retrieve the posted data from the form within your server. Then send the payment request to the DOKU server to be processed using our function sample.

Response sample

{

"res_response_msg":"SUCCESS",

"res_transaction_code":"d4efbb8c4ebb9a3597c05aa32f2b341e77f98e63",

"res_mcn":"4***********1111",

"res_approval_code":"1234",

"res_trans_id_merchant":"1706332101",

"res_payment_date":"20160319184828",

"res_bank":"MANDIRI CLICK PAY",

"res_amount":"30000.00",

"res_message":"PAYMENT APPROVED",

"res_response_code":"0000",

"res_session_id":"50d240541f4d8d7565b18cb5ca93a660"

}

Step 6: DOKU server will send payment response in JSON.

API

Endpoint

| Action | URL | Description |

|---|---|---|

| prePayment | http://staging.doku.com/api/payment/PrePayment |

|

| payment | http://staging.doku.com/api/payment/paymentMip |

|

| directPayment | http://staging.doku.com/api/payment/PaymentMIPDirect |

|

| generateCode | http://staging.doku.com/api/payment/DoGeneratePaycodeVA |

for 8 digits request |

http://staging.doku.com/api/payment/doGeneratePaymentCode |

for 11 digits request |

Request Parameters

| Name | Type | Length | Description |

|---|---|---|---|

| req_mall_id or req_merchant_code | N | Given by DOKU. Use "req_mall_id" for VA or Mandiri Clickpay payment channel. Use "req_merchant_code" for Credit Card or DOKU Wallet payment channel. | |

| req_chain_merchant | N | Given by DOKU, if not using Chain, default value is "NA" | |

| req_amount | N | 12.2 | Total amount. Eg:10000.00 |

| req_purchase_amount | N | 12.2 | Total amount. Eg:10000.00 |

| req_trans_id_merchant or req_transaction_id | AN | …30 | Transaction ID from Merchant. Use "req_trans_id_merchant" for VA or Mandiri Clickpay payment channel. Use "req_transaction_id" for Credit Card or DOKU Wallet payment channel. |

| req_words | AN | …200 | Hashed key combination encryption (use SHA1 method). For credit card, combined parameters value in order: req_amount+req_merchant_code+(shared key)+req_transaction_id+req_purchase_currency+token_id+pairing_code. For Mandiri ClickPay, combined parameters value in order: req_amount+req_mall_id+(shared key)+req_trans_id_merchant+req_currency |

| req_request_date_time | N | 14 | YYYYMMDDHHMMSS |

| req_currency | N | 3 | ISO3166 , numeric code |

| req_purchase_currency | N | 3 | ISO3166 , numeric code |

| req_session_id | AN | …48 | Session ID from Merchant |

| req_name | AN | …50 | Travel arranger name / buyer name |

| req_email | ANS | …100 | Customer email |

| req_basket | ANS | …1024 | Show transaction description. Use comma to separate each field and semicolon for each item. Item 1, 1000.00.,2,20000,00;item2,15000.00,2,30000.00 |

| token_id | AN | Sent by DOKU during getToken process | |

| req_shipping_address | ANS | …100 | Shipping address contains street and number |

| req_shipping_city | ANS | …100 | City name |

| req_shipping_state | AN | …100 | State / province name |

| req_shipping_country | A | 2 | ISO3166, alpha-2. Mandatory for credit card and DOKU Wallet payment |

| req_shipping_zip_code | N | …10 | Zip Code. Mandatory for credit card and DOKU Wallet payment |

| req_payment_channel | N | 2 | See payment channel code |

| req_address | ANS | …100 | Home address contains street and number. Mandatory for credit card and DOKU Wallet payment |

| req_city | ANS | …100 | City name |

| req_state | AN | …100 | State / province name |

| req_country | A | 2 | ISO3166, alpha-2 |

| req_zip_code | N | …10 | Zip Code |

| req_mobile_phone | ANS | …15 | Home Phone |

| req_work_phone | ANS | …13 | Work Phone / Office Phone |

| req_birth_date | N | …8 | YYYYMMDD |

| req_form_type | AN | Full/Inline | |

| req_domain_valid | ANS | Merchant's website domain | |

| req_timeout | N | Timeout transactions in minutes | |

| req_bin_filter | ANS | Example: "42*1", "4?3??3","411111","5*" | |

| req_expiry_time | N | VA number expiry time. Default is '360' |

Additional Parameters for Airline Merchant

| Name | Type | Length | Description |

|---|---|---|---|

| req_flight | N | 2 | 01 for Domestic, 02 for International |

| req_flight_type | N | 1 | 0 : One Way, 1 : Return, 2 : Transit, 3 : Transit & Return, 4 : Multiple Cities |

| req_booking_code | AN | …20 | Booking code generated by Airline |

| req_vat | N | Total VAT. Eg: 10000.00 |

|

| req_insurance | N | Total Insurance. Eg: 10000.00 |

|

| req_fuel_surcharge | N | Total fuel surcharge. Eg: 10000.00 |

|

| req_route | AN | …50 | List of route using format XXX-YYY (from XXX to YYY). E.g. : CGK-DPS |

| req_flight_date | N | 8 | List of flight date using format YYYYMMDD |

| req_flight_time | N | 6 | List of flight time using format HHMMSS |

| req_flight_number | AN | …30 | List of flight number using IATA Standard. XXYYYY (XX = Airline Name, YYYY = Flight Number) |

| req_passenger_name | AN | …50 | List of passenger name in one booking code |

| req_passenger_type | AN | 1 | List of passenger type in one booking. A : Adult, C : Child |

| req_ff_number | AN | …1024 | Frequent Flyer Number |

| req_thirdparty_status | ANS | 1 | 0 : Travel Arranger joins the flight, 1 : Travel Arranger does not join the flight |

Additional Parameters for Credit Card Installment

| Name | Type | Length | Description |

|---|---|---|---|

| req_installment_acquirer | N | 3 | Acquirer code for installment |

| req_tenor | N | 2 | Number of month to pay the installment |

| req_plan_id | N | 3 | Promotion ID from the bank for the current merchant |

| req_installment_off_us | AN | 1 | Default value null for on-us installment. For off-us installment send "O" |

Additional Parameters for Tokenization

| Name | Type | Length | Description |

|---|---|---|---|

| req_customer_id | AN | …16 | Merchant’s customer identifier |

| req_token_payment |

Additional Parameters for Authorize & Capture

| Name | Type | Length | Description |

|---|---|---|---|

| req_authorize_expiry_date | N | 6 | Expiry time of the payment Authorization (in minutes). Maximum is 15 days |

| req_payment_type | N | …10 | Please enter ‘A’ for Authorize |

| req_approval_code | Received from DOKU during Authorize process |

Other API & Callback

Other Payment Request

| Endpoint | HTTP Method | Definition |

|---|---|---|

| /Suite/ReceiveMIP | POST | To check the status of a Transaction, Merchant server send request to DOKU server where DOKU server will response with Transaction Status in XML format. |

Other Payment Request Parameter

| Parameter | Type | Length | Description |

|---|---|---|---|

| MALLID | N | 10 | Merchant ID given by Doku |

| CHAINMERCHANT | N | 8 | Given by Doku. If not using Chain, use value: NA |

| AMOUNT | N | 12.2 | Total amount. Eg: 10000.00 |

| PURCHASEAMOUNT | N | 12.2 | Total amount. Eg: 10000.00 |

| TRANSIDMERCHANT | AN | 30 | Transaction ID from Merchant |

| WORDS | AN | 254 | Hashed key combination encryption. The hashed key generated from combining these parameters value in this order:AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT For transaction with currency other than 360 (IDR), use: AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT+CURRENCY For Shared Key, refer to Shared Key Hashed Value |

| REQUESTDATETIME | N | 14 | YYYYMMDDHHMMSS |

| CURRENCY | N | 3 | ISO3166, numeric code |

| PURCHASECURRENCY | N | 3 | ISO3166, numeric code |

| SESSIONID | AN | 48 | Merchant can use this parameter for additional validation, DOKU will return the value in other response process. |

| NAME | AN | 128 | Customer / Buyer name |

| ANS | 100 | Customer / Buyer email | |

| USERIDKLIKBCA | ANS | 12 | Customer KLIKBCA user ID. Mandatory for KLIKBCA payment |

| ADDITIONALDATA | ANS | 1024 | Custom additional data for specific merchant use |

| BASKET | ANS | 1024 | Show transaction description. Use comma to separate each field and semicolon for each item. E.g. Item1,1000.00,2,20000.00;item2,15000.00,2,30000.00 |

| PAYMENTCHANNEL | N | 2 | See Payment Channel Code |

| EXPIRYTIME | N | 14 | Expiry time for BNI Yap bill. Format: YYYYMMDDHHMMSS |

Other Payment Response sample

<?xml version="1.0" encoding="UTF-8"?>

<PAYMENT_RESPONSE>

<RESPONSECODE>0000</RESPONSECODE>

<RESPONSEMSG>SUCCESS</RESPONSEMSG>

</PAYMENT_RESPONSE>

Other Payment Response

Request will be responded in XML format.

| Parameter | Type | Length | description |

|---|---|---|---|

| RESPONSECODE | N | 4 | Request response code |

| RESPONSEMSG | A | ..20 | Request message |

Check Status Request

| Endpoint | HTTP Method | Definition |

|---|---|---|

| /Suite/CheckStatus | POST | To check the status of a Transaction, Merchant server send request to DOKU server where DOKU server will response with Transaction Status in XML format. |

Check Status Request Parameter

| Parameter | Type | Length | Description |

|---|---|---|---|

| MALLID | N | 10 | Merchant ID given by Doku |

| CHAINMERCHANT | N | 8 | Given by Doku. By default NA |

| SESSIONID | AN | 48 | Original value from Sale Request |

| TRANSIDMERCHANT | AN | 40 | Transaction ID from Merchant |

| WORDS | AN | 254 | Hashed key combination encryption. The hashed key generated from combining these parameters value in this order: 1. MALLID+SHAREDKEY+TRANSIDMERCHANT 2. Has Rate or Has Purchase Currency and Purchase Currency not equals to 360:MALLID+SHAREDKEY+TRANSIDMERCHANT+PURCHASECURRENCY |

| Refer to Shared Key Hashed Value | |||

| PAYMENTCHANNEL | 2 | See Payment Channel Code section | |

| CURRENCY | N | 3 | ISO3166 , numeric code |

| PURCHASECURRENCY | N | 3 | ISO3166 , numeric code |

| PAYMENTTYPE | N | AUTHORIZATION, or CAPTURE. If not sent, last transaction will be responded |

Check Status Response

DOKU will echo payment status in XML format.

Check Status Response (Sample)

<PAYMENT_STATUS>

<PAYMENTDATETIME>20171009174223</PAYMENTDATETIME>

<PURCHASECURRENCY>360</PURCHASECURRENCY>

<LIABILITY>MERCHANT</LIABILITY>

<PAYMENTCHANNEL>15</PAYMENTCHANNEL>

<AMOUNT>10000.00</AMOUNT>

<PAYMENTCODE/>

<MCN>451249******2345</MCN>

<WORDS>a918da739a43386a42650f58fd3e654b2fc8574e</WORDS>

<RESULTMSG>SUCCESS</RESULTMSG>

<VERIFYID/>

<TRANSIDMERCHANT>4D169kaIAVVz</TRANSIDMERCHANT>

<BANK>Bank BNI</BANK>

<STATUSTYPE>P</STATUSTYPE>

<APPROVALCODE>683228</APPROVALCODE>

<EDUSTATUS>PENDING</EDUSTATUS>

<THREEDSECURESTATUS>FALSE</THREEDSECURESTATUS>

<VERIFYSCORE>-1</VERIFYSCORE>

<CURRENCY>360</CURRENCY>

<RESPONSECODE>0000</RESPONSECODE>

<CHNAME>test</CHNAME>

<BRAND>VISA</BRAND>

<VERIFYSTATUS>REVIEW</VERIFYSTATUS>

<REFUND_LIST>

<REFUND>

<REFUNDIDMERCHANT>1500544822224</REFUNDIDMERCHANT>

<REFNUMBER>935595</REFNUMBER>

<AMOUNT>1000.00</AMOUNT>

</REFUND>

<REFUND>

<REFUNDIDMERCHANT>1500544822225</REFUNDIDMERCHANT>

<REFNUMBER>285032</REFNUMBER>

<AMOUNT>1000.00</AMOUNT>

</REFUND>

</REFUND_LIST>

<SESSIONID>2cAuNfAlKT7RaU83nwI0</SESSIONID>

</PAYMENT_STATUS>

| Parameter | Type | Length | Description |

|---|---|---|---|

| AMOUNT | N | 12.2 | Total amount. Eg: 10000.00 |

| TRANSIDMERCHANT | AN | 30 | Transaction ID from Merchant |

| WORDS | AN | 200 | Hashed key combination encryption. The hashed key generated from combining these parameters value in this order: AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT+RESULTMSG+VERIFYSTATUS |

For transaction with currency other than 360 (IDR), use : AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT+RESULTMSG+VERIFYSTATUS+CURRENCY |

|||

| Refer to Shared Key Hashed Value | |||

| RESPONSECODE* | N | 4 | 0000: Success, others Failed |

| APPROVALCODE | AN | 20 | Transaction number from bank |

| RESULTMSG* | A | 20 | SUCCESS or FAILED |

| PAYMENTCHANNEL | N | 2 | See payment channel code list |

| PAYMENTCODE | N | 8 | Virtual Account identifier for VA transaction. Has value if using Channel that has payment code. |

| SESSIONID | AN | 48 | DOKU will return the value from Payment Request. |

| BANK | AN | 100 | Bank Issuer |

| MCN | ANS | 16 | Masked card number |

| PAYMENTDATEANDTIME | N | 14 | YYYYMMDDHHMMSS |

| VERIFYID | N | 30 | Generated by Fraud Screening (RequestID) |

| VERIFYSCORE | N | 3 | -1 or 0 to 100 |

| VERIFYSTATUS | A | 10 | APPROVE / REJECT / REVIEW / HIGHRISK / NA |

| CURRENCY | N | 3 | ISO3166 , numeric code |

| PURCHASECURRENCY | N | 3 | ISO3166 , numeric code |

| BRAND | A | 10 | VISA / MASTERCARD |

| CHNAME | AN | 50 | Cardholder Name |

| THREEDSECURESTATUS | A | 5 | TRUE or FALSE |

| LIABILITY | A | 10 | CUSTOMER / MERCHANT / NA |

| EDUSTATUS | A | 10 | Manual Fraud Review, value : APPROVE / REJECT / NA (default) |

* Main identifier of transaction success / failed

Inquiry Callback

Inquiry is used only for Direct Inquiry Virtual Account flow. Merchant should inform the URL where DOKU server will send inquiry request. You can configure the URL in "Identify URL" on DOKU Merchant Dashboard Settings. Example: http://www.yourwebsite.com/directory/DOKU_redirect.php

Inquiry Parameters Sent

| Parameter | Type | Length | Description |

|---|---|---|---|

| MALLID | N | 10 | Merchant ID given by Doku |

| CHAINMERCHANT | N | 8 | Given by Doku. By default NA |

| PAYMENTCHANNEL | N | 2 | See Payment Channel Code |

| PAYMENTCODE | N | 8 | Virtual Account identifier for VA transaction |

| WORDS | AN | 200 | Hashed key combination encryption. The hashed key generated from combining these parameters value in this order:MALLID+PAYMENTCODE |

| Refer to Shared Key Hashed Value |

Merchant Inquiry Response

DOKU will expect response Inquiry from merchant in XML format with these parameters:

Inquiry Response (Sample)

<INQUIRY_RESPONSE>

<PAYMENTCODE>8975011200005642</PAYMENTCODE>

<AMOUNT>100000.00</AMOUNT>

<PURCHASEAMOUNT>100000.00</PURCHASEAMOUNT>

<MINAMOUNT>10000.00</MINAMOUNT>

<MAXAMOUNT>550000.00</MAXAMOUNT>

<TRANSIDMERCHANT>1396430482839</TRANSIDMERCHANT>

<WORDS>b5a22f37ad0693ebac1bf03a89a8faeae9e7f390</WORDS>

<REQUESTDATETIME>20140402162122</REQUESTDATETIME>

<CURRENCY>360</CURRENCY>

<PURCHASECURRENCY>360</PURCHASECURRENCY>

<SESSIONID>dxgcmvcbywhu3t5mwye7ngqhpf8i6edu</SESSIONID>

<NAME>Nama Lengkap</NAME>

<EMAIL>nama@xyx.com</EMAIL>

<BASKET>ITEM 1,10000.00,2,20000.00;ITEM 2,20000.00,4,80000.00</BASKET>

<ADDITIONALDATA>BORNEO TOUR AND TRAVEL</ADDITIONALDATA>

<RESPONSECODE>0000</RESPONSECODE>

</INQUIRY_RESPONSE>

| Parameter | Type | Length | Description |

|---|---|---|---|

| PAYMENTCODE | N | 16 | Virtual Account identifier for VA transaction |

| AMOUNT | N | 12.2 | Total amount. If open amount, please set 0. Eg: 10000.00 |

| PURCHASEAMOUNT | N | 12.2 | Total amount. If open amount, please set 0. E.g.: 10000.00 |

| MINAMOUNT | N | 12.2 | If merchant implement open amount scheme, it is suggested to set this parameter. e.g.: 10000.00 |

| MAXAMOUNT | N | 12.2 | If merchant implement open amount scheme, it is suggested to set this parameter. e.g. 500000.00 |

| TRANSIDMERCHANT | AN | 48 | Transaction ID from Merchant |

| WORDS | AN | 254 | Hashed key combination encryption (use SHA1 method). The hashed key generated from combining these parameters value in this order: AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT Refer to Shared Key Hashed Value |

| REQUESTDATETIME | N | 14 | YYYYMMDDHHMMSS |

| CURRENCY | N | 3 | ISO3166 , numeric code |

| PURCHASECURRENCY | N | 3 | ISO3166 , numeric code |

| SESSIONID | AN | 48 | DOKU will return the value from Payment Request |

| NAME | AN | 50 | Customer / Buyer name |

| ANS | 100 | Customer / Buyer email | |

| BASKET | ANS | 1024 | Show transaction description. Use comma to separate each field and semicolon for each item. E.g. Item1,1000.00,2,20000.00;item2,15000.00,2,30000.00 |

| ADDITIONALDATA | ANS | 1024 | Custom additional data for specific merchant use |

| RESPONSECODE | N | 4 | 3000 = Bill not found 3001 = Decline 3002 = Bill already paid 3004 = Account number / Bill was expired 3006 = VA Number not found 0000 = Success 9999 = Internal Error / Failed |

Capture Request

| Endpoint | HTTP Method | Definition |

|---|---|---|

| /Suite/CaptureRequest | POST | Capture is to confirm Authorize transaction. |

Capture Request Parameter

| Parameter | Type | Length | Description |

|---|---|---|---|

| MALLID | N | 10 | Merchant ID given by Doku |

| CHAINMERCHANT | N | 8 | Given by Doku. By default NA |

| TRANSIDMERCHANT | AN | 30 | Transaction ID from Merchant |

| APPROVALCODE | N | 20 | Transaction ID from Bank |

| AMOUNT | N | 12.2 | Total amount. e.g.: 10000.00 |

| PURCHASEAMOUNT | N | 12.2 | Total amount. e.g.: 10000.00 |

| CURRENCY | AN | 3 | ISO3166 , numeric code |

| PURCHASECURRENCY | N | 3 | ISO3166 , numeric code |

| SESSIONID | AN | 48 | Original value from Authorization request |

| WORDS | N | 254 | Hashed key generated from combining these parameters value in this order : MALLID+ Refer to Shared Key Hashed Value |

| PAYMENTCHANNEL | AN | 2 | Only for Credit Card (15) |

Capture Response

Capture response sample

<?xml version="1.0"?>

<PAYMENT_STATUS>

<AMOUNT></AMOUNT>

<TRANSIDMERCHANT></TRANSIDMERCHANT>

<WORDS></WORDS>

<RESPONSECODE></RESPONSECODE>

<APPROVALCODE></APPROVALCODE>

<RESULTMSG></RESULTMSG>

<PAYMENTCHANNEL></PAYMENTCHANNEL>

<SESSIONID></SESSIONID>

<MCN></MCN>

<PAYMENTDATETIME></PAYMENTDATETIME>

<CURRENCY></CURRENCY>

<PURCHASECURRENCY></PURCHASECURRENCY>

</PAYMENT_STATUS>

| Parameter | Type | Length | Description |

|---|---|---|---|

| AMOUNT | N | 12.2 | Total amount. Eg: 10000.00 |

| TRANSIDMERCHANT | AN | 30 | Transaction ID from Merchant |

| WORDS | AN | 200 | Hashed key combination encryption. The hashed key generated from combining these parameters value in this order: AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT+RESULTMSG For transaction with currency other than 360 (IDR), use : AMOUNT+MALLID+SHAREDKEY+TRANSIDMERCHANT+RESULTMSG+VERIFYSTATUS+CURRENCY |

| Refer to Shared Key Hashed Value | |||

| RESPONSECODE* | N | 4 | 0000: Success, others Failed |

| APPROVALCODE | AN | 20 | Transaction number from bank |

| RESULTMSG* | A | 20 | SUCCESS or FAILED |

| PAYMENTCHANNEL | N | 2 | See Payment Channel Code |

| SESSIONID | AN | 48 | DOKU will return the value from Payment Request. |

| MCN | ANS | 16 | Masked card number |

| CURRENCY | N | 3 | ISO3166 , numeric code |

| PURCHASECURRENCY | N | 3 | ISO3166 , numeric code |

* Main identifier of transaction success / failed

Void Request

| Endpoint | HTTP Method | Definition |

|---|---|---|

| /Suite/VoidRequest | POST | Void is a feature to cancel successful unsettled transaction. |

Void Request Parameter

| Parameter | Type | Length | Description |

|---|---|---|---|

| MALLID | N | 10 | Merchant ID given by Doku |

| CHAINMERCHANT | N | 8 | Given by Doku. By default NA |

| TRANSIDMERCHANT | AN | 30 | Transaction ID from Merchant |

| SESSIONID | AN | 48 | Original value from Sale Request |

| WORDS | AN | 254 | Hashed key combination encryption. The hashed key generated from combining these parameters value in this order: |

| Refer to Shared Key Hashed Value | |||

| PAYMENTCHANNEL | N | 2 | See Payment Channel Code list |

Void Response sample

SUCCESS

or

FAILED;Transaction Not Found

Void Response

Void response will be in plain text.

| Response | Description |

|---|---|

| SUCCESS | Void request success |

| FAILED;[error message] | error message: "Transaction Not Found" or "Transaction Cannot Void" |

Refund Request

| Endpoint | HTTP Method | Definition |

|---|---|---|

| /Suite/DoRefundRequest | POST | Refund allows Merchant to Refund Sale & Installment on-us Transaction |

Refund Request Parameter

| Parameter | Type | Length | Description |

|---|---|---|---|

| MALLID | N | 10 | Merchant ID given by Doku |

| CHAINMERCHANT | N | 8 | Given by Doku. By default NA |

| REFIDMERCHANT | N | 30 | New Refund Transaction ID from Merchant |

| TRANSIDMERCHANT | AN | 30 | Original Transaction ID from Merchant |

| APPROVALCODE | AN | 20 | Transaction number from Bank |

| AMOUNT | N | 12.2 | Total VOID / REFUND amount |

| CURRENCY | N | 3 | ISO3166, numeric code |

| REFUNDTYPE | N | 2 | 01 = Full Refund, 02 = Partial Refund Credit (Credit to customer account), 03 = Partial Refund Debit (debit from customer account) |

| SESSIONID | AN | 48 | Merchant can use this parameter for additional validation, DOKU will return the value in other response process |

| WORDS | AN | 254 | Hashed key combination encryption. The hashed key generated from combining these parameters value in this order:AMOUNT+MALLID+SHAREDKEY+REFIDMERCHANT+SESSIONID |